what is the tax rate in tulsa ok

This is the total of state county and city sales tax rates. State of Oklahoma 45.

The Impact Of The Coverage Gap For Adults In States Not Expanding Medicaid By Race And Ethnicity Kff Medicaid Family Foundations Participation Rate

This is the total of state and county sales tax rates.

. The latest sales tax rate for Tulsa County OK. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. How much is tax by the dollar in Tulsa Oklahoma.

The latest sales tax rates for cities in Oklahoma OK state. This includes the rates on the state county city and special levels. The total sales tax rate in any given location can be broken down into state county city and special district rates.

However left to the county are evaluating property mailing billings taking in the levies engaging in. Tulsa has parts of it located within Creek County Osage. Sales Tax in Tulsa.

The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. Rates include state county and city taxes.

City 365. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The Oklahoma sales tax rate is currently. By mail Make checks payable to the City of Tulsa and mail to the City of Tulsa Lodging Tax Processing Center 8839 North Cedar Avenue 212 Fresno CA 93720. This is the total of state county and city sales tax rates.

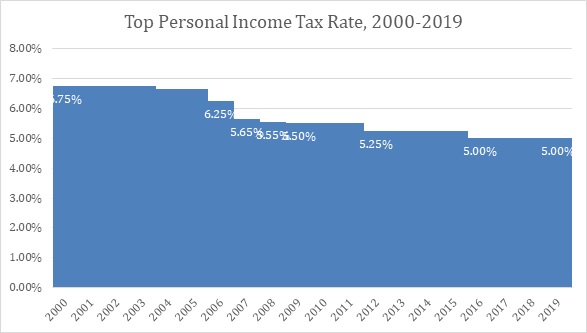

State of Oklahoma 45. For the 2020 tax year Oklahomas top income tax rate is 5. Detailed Oklahoma state income tax rates and brackets are available on this page.

Inside the City limits. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. 2020 rates included for use while preparing your income tax deduction.

Online You will need. Oklahoma state income tax rate table for the 2022 - 2023 filing season has six income tax brackets with OK tax rates of 025 075 175 275 375 and 475 for. The Oklahoma state sales tax rate is currently.

The latest sales tax rate for Tulsa OK. Does Tulsa have income tax. 2020 rates included for use while preparing your income tax deduction.

The average cumulative sales tax rate in Tulsa Oklahoma is 831. 16 rows The Tulsa County. This rate includes any state county city and local sales taxes.

What is the sales tax rate in New Tulsa Oklahoma. While maintaining constitutional limitations mandated by law the city sets tax rates. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

2020 rates included for use while preparing your income tax deduction. Tulsa County 0367. The total sales tax rate charged within.

The minimum combined 2022 sales tax rate for New Tulsa Oklahoma is 98. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. This rate includes any state county city and local sales taxes.

What is the sales tax rate in Tulsa OK. Oklahoma has a 45 sales tax and Tulsa County collects an additional. Tulsa County collects on average 106 of a propertys assessed.

What is the sales tax rate in Claremore OK. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is. 2483 lower than the maximum sales tax in OK.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Total Sales Tax Per Dollar By City Oklahoma Watch

Taxes Broken Arrow Ok Economic Development

![]()

Free Oklahoma Payroll Calculator 2022 Ok Tax Rates Onpay

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales And Use Tax Rate Locator

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Pin On Music And Band Memorabilia Press Kits Ticket Stubs

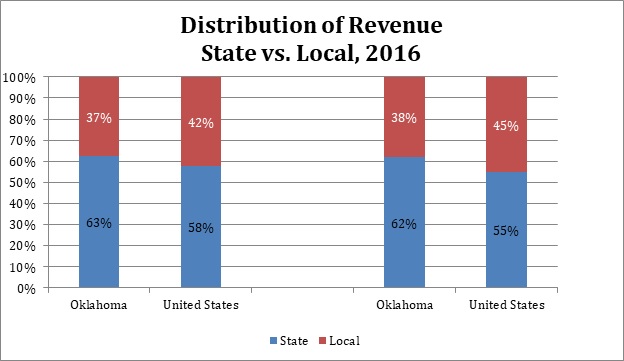

State And Local Tax Distribution Oklahoma Policy Institute

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

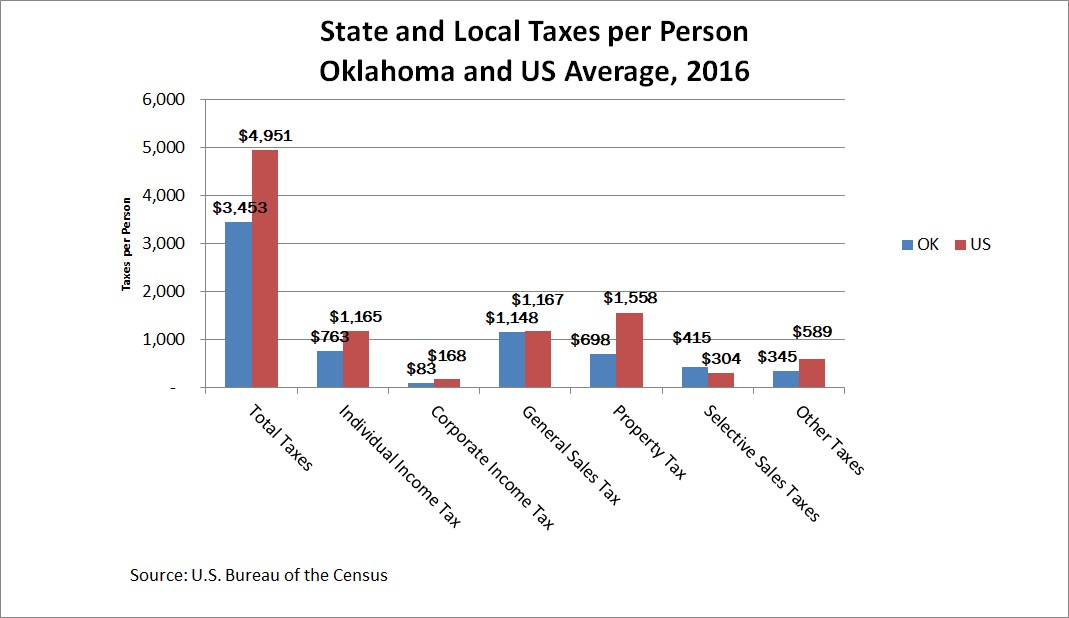

How Oklahoma Taxes Compare Oklahoma Policy Institute

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Truck Accessories Sprint Cars

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Individual Income Tax Oklahoma Policy Institute